As the NY Times notes, “The vast majority of drugs dispensed in the United States—more than 80 percent—are generics, which are low-cost alternatives to brand-name drugs. If your doctor writes you a prescription, there is a very good chance it will cost you $10 or less."i

Of the remaining small portion of brand-name prescriptions, the vast majority of those also are generally not considered expensive. Rather, the debate around “expensive” drugs tends to focus on so-called “specialty” drugs—those that treat serious or life-threatening diseases such as cancer, multiple sclerosis, hepatitis C, and diabetes, and can cost thousands of dollars or more for a course of treatment.

Less than 5% of patients take such drugs, but due to their higher costs, such drugs account for about a third of total drug spending.

Even so, it is undisputed that most drug spending goes toward inexpensive prescriptions that are the most cost-effective way to cure, treat, or manage disease.

Additional Reading & Resources

Biopharmaceuticals provide enormous value to society

Modern biotechnology is a young industry. But in just a few decades, the entrepreneurs, scientists and researchers working in this field have firmly established themselves at the forefront of medical innovation. Their work is transforming the way we treat – and now even cure – patients with a wide range of once-devastating diseases:

- Hepatitis C—A once incurable disease that now has cure rates above 90%ii

- HIV/AIDS—once a death sentence, it’s now a chronic manageable conditioniii

- Cancer—83% of children with cancer now survive, compared to 58% in 1970iv; and

- Vaccines—more than 730,000 children’s lives have been saved in the last 20 years in the United States because of advances in vaccines.v

In addition to saving and improving lives, innovative drugs also can provide enormous savings in other health care spending. For example, studies show that:

- Every additional $1 spent on congestive heart failure medicine for adherent patients saves eight times that much in other health care services, with similar trends for patients with diabetes, hypertension and high cholesterolvi

- The creation of Medicare prescription drug coverage for seniors has resulted in annual hospitalization savings of an estimated $1.5 billion per yearvii

- The 22 percent reduction in cancer death rates since 1991 due to new medicines has generated nearly $2 trillion in societal benefitviii

While sometimes expensive, these costs must be seen in the proper perspective: the value of innovative biopharmaceuticals to patients and their loved ones, and to society, is truly incalculable.

Additional Reading & Resources

CBS News; Immunotherapy: The next frontier in cancer treatment

Goldman, D.P., et al., The value of specialty oncology drugs. Health services research, 2010. 45(1): p. 115-132.

Goldman, D.P., et al., Early HIV treatment in the United States prevented nearly 13,500 infections per year during 1996–2009. Health Affairs, 2014. 33(3): p. 362-369.

Grabowski, D.C., et al., The large social value resulting from use of statins warrants steps to improve adherence and broaden treatment. Health Affairs, 2012. 31(10): p. 2276-2285.

Lakdawalla, D.N., et al., How cancer patients value hope and the implications for cost-effectiveness assessments of high-cost cancer therapies. Health Affairs, 2012. 31(4): p. 676-682.

Philipson, T.J. and A.B. Jena. Who benefits from new medical technologies? Estimates of consumer and producer surpluses for HIV/AIDS drugs. in Forum for Health Economics & Policy. 2006.

Van Nuys, K., et al., Broad Hepatitis C Treatment Scenarios Return Substantial Health Gains, But Capacity Is A Concern. Health Affairs, 2015. 34(10): p. 1666-1674.

Romley, J.A., et al., Early HIV treatment led to life expectancy gains valued at $80 billion for people infected in 1996–2009. Health Affairs, 2014. 33(3): p. 370-377.

Lichtenberg Frank, R., Pharmaceutical Price Discrimination and Social Welfare, in Capitalism and Society. 2010.

Innovation Saves; Hepatitis C

Innovation Saves; HIV/AIDS

Innovation Saves; Cancer

Innovation Saves; Vaccines

Innovation Saves; Savings

Initial pricing for innovative drugs is only temporary

The biopharmaceutical industry is unique in that there are regulated pathways that allow for similar versions of drugs or therapies, known as generics or biosimilars, to be brought to market by competitors without having to do all of the same safety and efficacy studies that the innovator had to do. In essence, the government is allowing one competitor to “free ride” off the massive investment made by the innovator, with the goal of facilitating market competition and lowering drug costs over time. But to give innovators a reasonable opportunity to secure a favorable return on their investments, federal law restricts generic or biosimilar competition for a limited period of time. This is the societal contract we’ve made with this life-saving industry – a limited period of premium pricing for an innovator, followed by cheaper generics thereafter.

This system largely has worked as intended, incentivizing amazing biomedical breakthroughs that are transforming the treatments and cure for once-devastating diseases. And once federal protections for these innovations expire, society is rewarded with lower-cost medicines (often costing less than $10 a prescription) for generations of patients to come. In fact, nearly 90 percent of all prescriptions filled in the United States today are for generic versions of once-novel drugs at a small fraction of the original prices – saving more than $1.4 trillion in drug costs over the last decade alone.ix

In short, the current system is working to drive innovation while also ensuring low costs for most medications.

Innovative drugs also often face vigorous brand-to-brand competition that already brings down price before generic entry.

Even during the period of time when federal law protects against generic copies of innovative medicines, these drugs often face vigorous brand-to-brand competition that drives down prices.

As the Federal Trade Commission (FTC) has noted, “[a]pproval of a breakthrough or pioneer drug product is increasingly followed by entry of a subsequent branded product(s). The head start that the breakthrough product has had over subsequent branded products has decreased over the past three decades from 8.2 years during the 1970s to 2.25 years in the 1990s."x

In fact, all of the breakthrough products studied during the 1990s had branded competitors in clinical development at or before their approval.xi Thus, the often-claimed notion that there is a lack of market competition among brand drugs or "monopolization" by brand drug companies is not accurate.

Take the case of the new class of innovative hepatitis C drugs.

Sovaldi, a first-in-class innovative drug that provides cure rates of approximately 90% for Hepatitis C, became available to patients in late 2013. By February 2015, the average discount to payers was already about 50% off its original price, due to intense market competition by new innovator entrants with comparable drugs. As drug market expert Adam Fein of Drug Channels notes, these “large price cuts provide more evidence that competition gives payers enormous power, even when purchasing differentiated, highly valuable therapies.”xii Indeed, the price of Sovaldi in the United States is now lower than the government-dictated price in the United Kingdom.xiii

Additional Reading & Resources

What Is the Role of Patents?

Patents protect the drug, and often its use or method of manufacture, and incentivize the R&D necessary to go from basic discovery, to translational and applied research, to the development and approval of an actual FDA-approved medicine that has been proven safe and effective through lengthy and expensive clinical trials. Typically, by the time a drug is finally approved by the FDA, there is roughly only 10 years left of the original 20-year patent term.

What Is the Role of Data Exclusivity?

Data exclusivity, on the other hand, protects innovators against competitors “free riding” on all that innovative R&D by seeking FDA approval of identical or highly similar molecules based on the innovators’ data. In other words, patents protect the invention, while data exclusivity protects the R&D needed to turn that invention into an FDA‑approved medicine.

While patents are a critical form of intellectual property, they are not always sufficient. The combination of patents and data exclusivity, which run concurrently, allow an innovator a reasonably predictable period of time on the market before government‑facilitated generic entry occurs.

Innovation is risky, time consuming, and expensive

"Creating new drugs through biotechnology is at the risky end of a business in which superhuman stamina and bottomless pockets are minimum requirements."

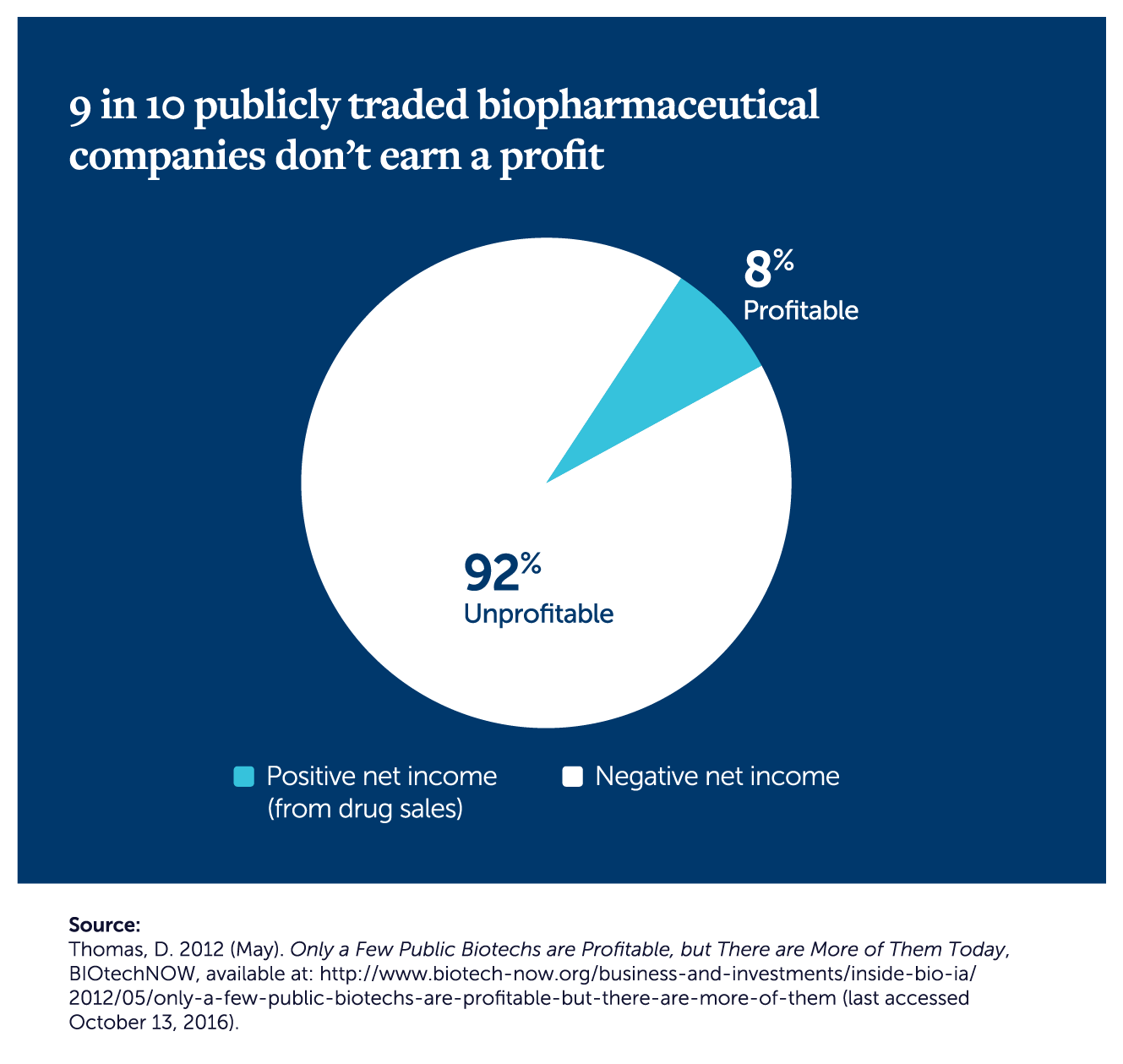

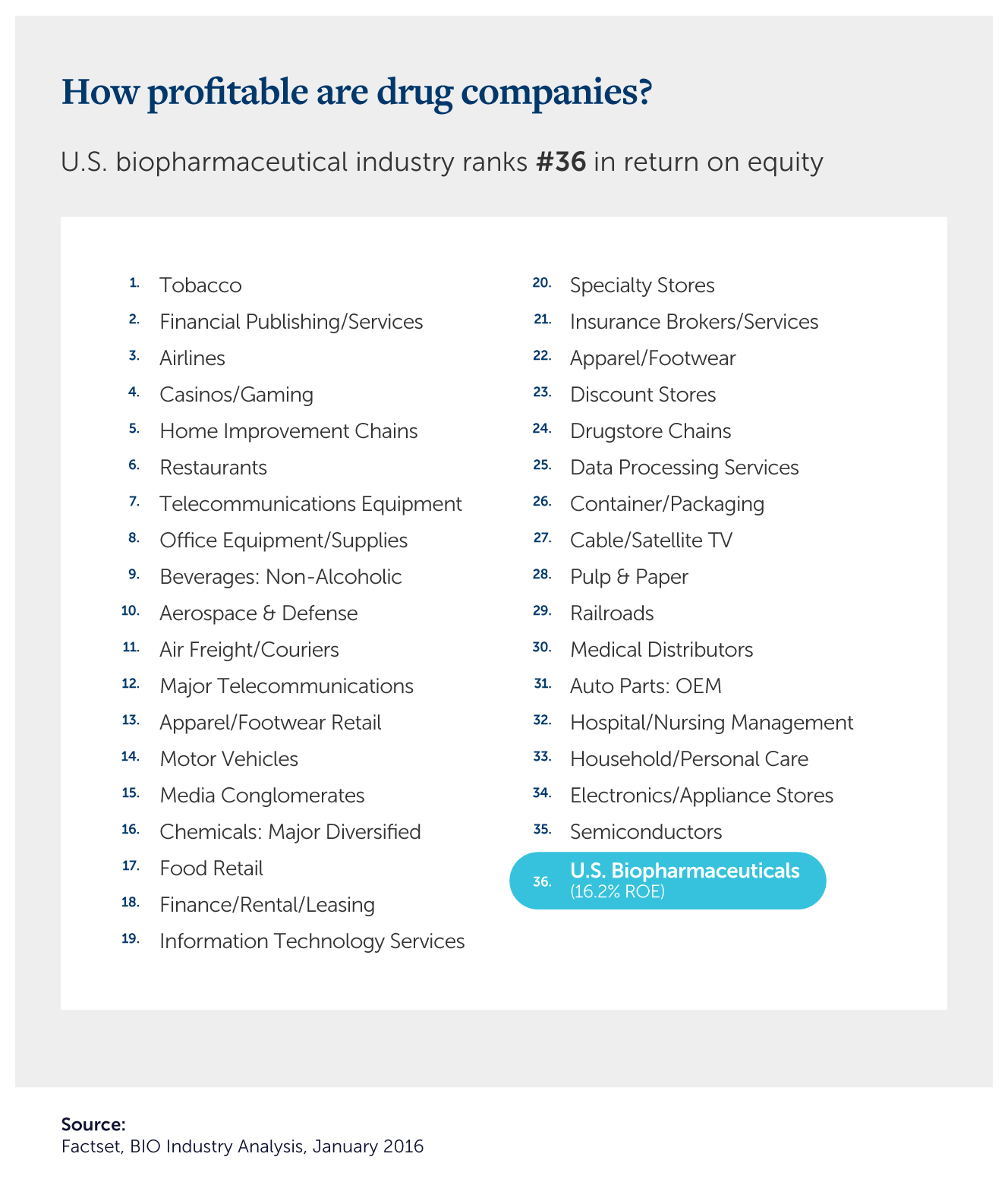

To get the complete picture of the cost of drug development, you need to consider the larger biomedical innovation ecosystem, where 90% of drug development programs fail…and 90% of biopharmaceutical companies are unprofitable.xiv In fact, the industry as a whole ranks a mediocre 36th in return on equity (ROE).xv

To sustain this innovative ecosystem, revenues from the few successes are needed to reward past investments (both those that were successful and those that were unsuccessful but still necessary to advance our scientific understanding), and to attract new investments to finance future research and development programs for patients in need.

Indeed, drug development requires and receives the highest levels of R&D reinvestment of any industry.xvi The pricing for new medicines must reflect the need to sustain this critical innovation ecosystem.

One additional thing to consider as you think about our drug development ecosystem:

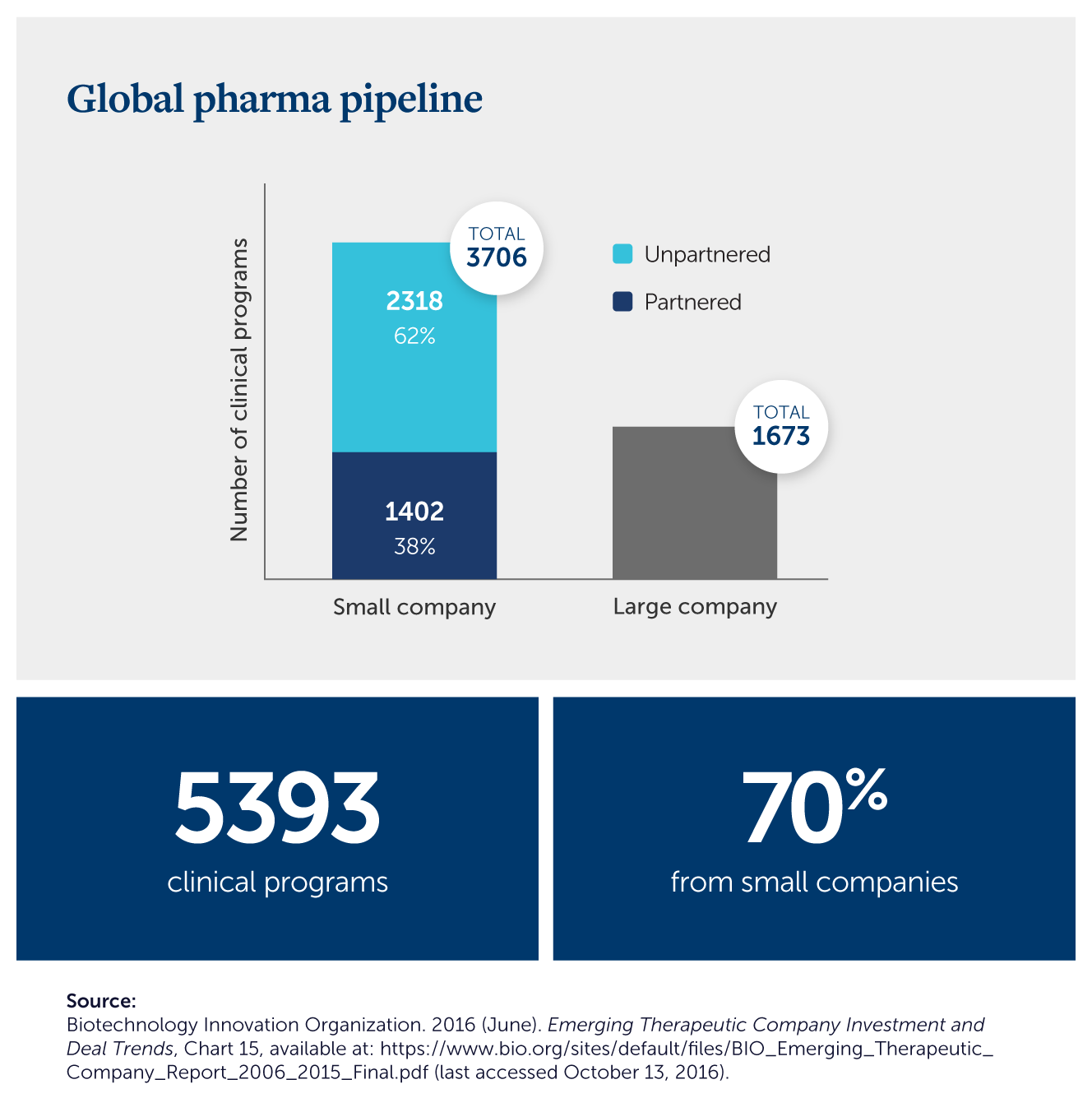

Small companies are at the forefront of cutting-edge, clinical trials for innovative new medicines, yet because they rely so heavily on private investment capital, they are the most susceptible to public policy changes that could harm investment incentives.

Additional Reading & Resources

Alzheimer’s Readiness Project; Here’s how medicines make their way from test tube to patient

References

- http://www.nytimes.com/2016/04/28/business/high-drug-prices-explained.html?_r=0

- http://www.fda.gov/ForConsumers/ConsumerUpdates/ucm405642.htm, http://www.nejm.org/doi/full/10.1056/NEJMoa1214853#t=article

- http://www.bloomberg.com/news/articles/2016-07-06/the-graying-face-of-hiv-spurs-race-to- simplify-therapies

- http://www.cancer.net/cancer-types/childhood-cancer/statistics

- http://www.nytimes.com/2015/09/15/science/732000-american-lives-saved-by-vaccination.html, http://www.cdc.gov/media/releases/2014/p0424-immunization-program.html

- http://content.healthaffairs.org/content/30/1/91.abstract

- http://www.jhsph.edu/news/news-releases/2014/medicare-prescription-drug-coverage-produced- savings-of-one-and-a-half-bil%20lion-dollars-a-year-in-first-four-years.html

- Fall in cancer deaths: http://onlinelibrary.wiley.com/doi/10.3322/caac.21208/pdf Societal benefit: http://www.nber.org/papers/w15574

- http://www.gphaonline.org/media/generic-drug-savings-2016/index.html

- https://www.ftc.gov/sites/default/files/documents/reports/emerging-health-care-issues-follow-biologic-drug-competition-federal-trade-commission-report/p083901biologicsreport.pdf

- Emerging Health Care Issues: Follow-on Biologic Drug Competition, Federal Trade Commission Report, June 2009 (citing Joseph A. DiMasi & Cherie Paquette, The Economics of Follow-on Drug Research and Development, 22 PHARMACOECONOMICS Supp 2:1-14 (2004) (The study included several biologic drugs); F.M. Scherer, Markets and Uncertainty in Pharmaceutical Development 13 (FACULTY RESEARCH WORKING PAPERS SER., HARV. UNIV., JOHN F. KENNEDY SCHOOL OF GOV’T, 2007), available at http://ksgnotes1.harvard.edu/Research/wpaper. nsf/rwp/RWP07-039/$File/rwp_07_039_scherer.pdf.

- Fein, A. Drug Channels. What Gilead’s Big Hepatitis C Discounts Mean for Biosimilar Pricing. Available at: http://www.drugchannels.net/2015/02/what-gileads-big-hepatitis-c-discounts.html. Accessed: September 7, 2016.

- http://www.forbes.com/sites/johnlamattina/2015/12/04/for-hepatitis-c-drugs-u-s-prices-are-cheaper-than-in-europe/#361ce40964bb

- Factset, BIO Industry Analysis

- Factset, BIO Industry Analysis

- Factset, BIO Industry Analysis